Car title loans Sulphur Springs TX provide swift funding but carry significant risks: high interest rates and potential vehicle repossession upon default. Popular among individuals with poor credit, these loans should be considered a last resort after exploring safer alternatives due to their potential impact on assets.

Car title loans Sulphur Springs TX can offer a quick financial fix, but it’s crucial to understand the risks and rewards before borrowing. This comprehensive guide breaks down the process, benefits, and drawbacks of these loans, specifically tailored to Sulphur Springs, TX. By navigating the potential risks and exercising informed decision-making, borrowers can access much-needed funds while minimizing detrimental effects on their financial health.

- Understanding Car Title Loans: A Comprehensive Overview

- Benefits and Drawbacks: Weighing Your Options

- Navigating Risks: Protecting Yourself Through Knowledge

Understanding Car Title Loans: A Comprehensive Overview

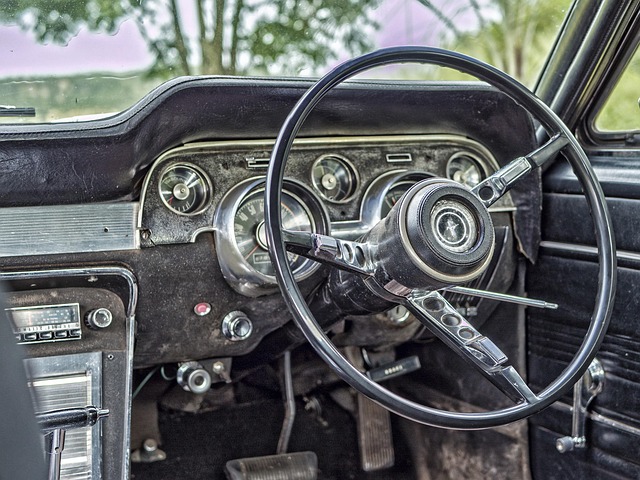

Car title loans Sulphur Springs TX are a type of secured loan that uses a vehicle’s title as collateral. This means the lender has the right to take possession of the vehicle if the borrower fails to repay the loan according to agreed terms. Unlike traditional loans, car title loans offer same-day funding and often have simpler application processes, making them attractive to those in need of quick cash.

These loans are particularly popular among individuals with poor credit or no credit history who may not qualify for other types of borrowing. However, it’s crucial to understand the risks involved. If the borrower defaults, they risk losing their vehicle. Moreover, car title loans often come with high-interest rates and fees, which can make them a costly borrowing option. Nevertheless, for those in urgent need of funds, secured loans like car title loans Sulphur Springs TX, even semi truck loans, can provide much-needed relief, especially when traditional financing options are not readily available.

Benefits and Drawbacks: Weighing Your Options

Car title loans Sulphur Springs TX can be a quick and accessible solution for those needing cash fast. One of the main benefits is the ease of approval, often with less stringent requirements compared to traditional bank loans. This makes them an attractive option for individuals with poor credit or no credit history. Additionally, the process is usually streamlined, allowing borrowers to receive funds within a short time frame.

However, there are significant drawbacks to consider. These loans are secured against your vehicle, which means if you fail to repay as agreed, the lender has the right to repossess your car. Loan refinancing options may be limited, and higher-than-average interest rates are common, potentially leading to a cycle of debt. Secured loans like these can put financial strain on borrowers, especially if unexpected expenses arise, making it even harder to stay current on loan payments. Weighing these benefits and drawbacks is crucial before taking out a car title loan in Sulphur Springs TX.

Navigating Risks: Protecting Yourself Through Knowledge

When considering car title loans Sulphur Springs TX, it’s crucial to understand that this type of borrowing comes with both risks and rewards. Before securing a loan using your vehicle’s title as collateral, it’s essential to familiarize yourself with potential pitfalls. One of the primary risks is the risk of losing your vehicle if you fail to repay the loan on time. This is because the lender holds the title during the loan period, meaning they have the right to repossess your car if there’s a default.

Education is your best defense against these risks. Researching and comparing lenders in advance can help ensure you’re dealing with a reputable and fair institution. Understanding the terms and conditions of the loan, including interest rates, repayment periods, and any hidden fees, will empower you to make an informed decision. Additionally, exploring alternatives like building emergency funds or seeking support from financial aid programs can mitigate the need for such loans. Remember, while car title pawns in Sulphur Springs TX may provide quick access to cash, they should be considered a last resort due to their potential impact on your asset.

Car title loans Sulphur Springs TX can provide a quick financial fix, but it’s crucial to navigate these options with caution. By understanding the risks and rewards outlined in this article—from interest rates to potential loss of your vehicle—you can make an informed decision. While car title loans offer access to immediate funds, prioritizing education and careful consideration is essential to protect yourself from steep fees and unforeseen circumstances.